colorado estate tax requirements

Deeds transferring Colorado real estate with a purchase price over 50000 are subject to an additional documentary fee similar to transfer taxes in other states. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to.

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

A state inheritance tax was enacted in Colorado in 1927.

. In general the tax does not apply to sales of services except for those. The documentary fee is. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone.

For information on how to file a Fiduciary Income Tax Return DR 0105 visit the Filing Information web page. Small estates under 50000 and no real property. The individual has incurred a Colorado tax liability for the tax year.

To be loyal and treat each party the same. The federal gift tax laws allow a person to give away up to 15000 each year. To put the interests of the estate in front of the personal representatives own interests.

Colorado imposes sales tax on retail sales of tangible personal property. If the estate or trust receives income a fiduciary income tax return must be filed. It currently costs 2 cents for every.

Colorado estate tax requirements Saturday March 19 2022 Edit. The Colorado income tax rate for tax years 2018 and prior was 463 for tax year 2019 was 45 and for tax year 2020 is 455. Updated July 22nd 2022.

To administer the estate with care and prudence. Colorado Proposition 121 the State Income Tax Rate Reduction Initiative is on the ballot in Colorado as an initiated state statute on November 8 2022. Real Wealth Network California S 1 Real Estate Club Creating Passive Income Real Estate Investing Estate.

Every resident estate or trust and nonresident estate or trust with Colorado-source income must file a Colorado fiduciary income tax return if it is required to file a federal income. Devisees or heirs may collect assets by using an affidavit. Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicatedThats especially true for any situation involving.

Download the Colorado Sales Tax Guide. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. The following table outlines Colorados probate and estate tax laws.

A gift can be made to an unlimited number of people and there is no need to file a tax return. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to. In Colorado the transfer tax is known as a documentary fee and its usually paid by buyers but this isnt set in stone.

A yes vote supports. Until 2005 a tax credit was allowed for federal estate. Apportionment percentage The apportionment percentage used.

The requirement to file also applies to any part-year resident who is either required to file a federal income tax return or has. Every resident estate or trust and nonresident estate or trust with Colorado-source income must file a Colorado fiduciary income tax return if it is required to file a federal income tax return or if.

Do I Need To Worry About Estate Or Inheritance Taxes The Hughes Law Firm

Estate Tax Definition Federal Estate Tax Taxedu

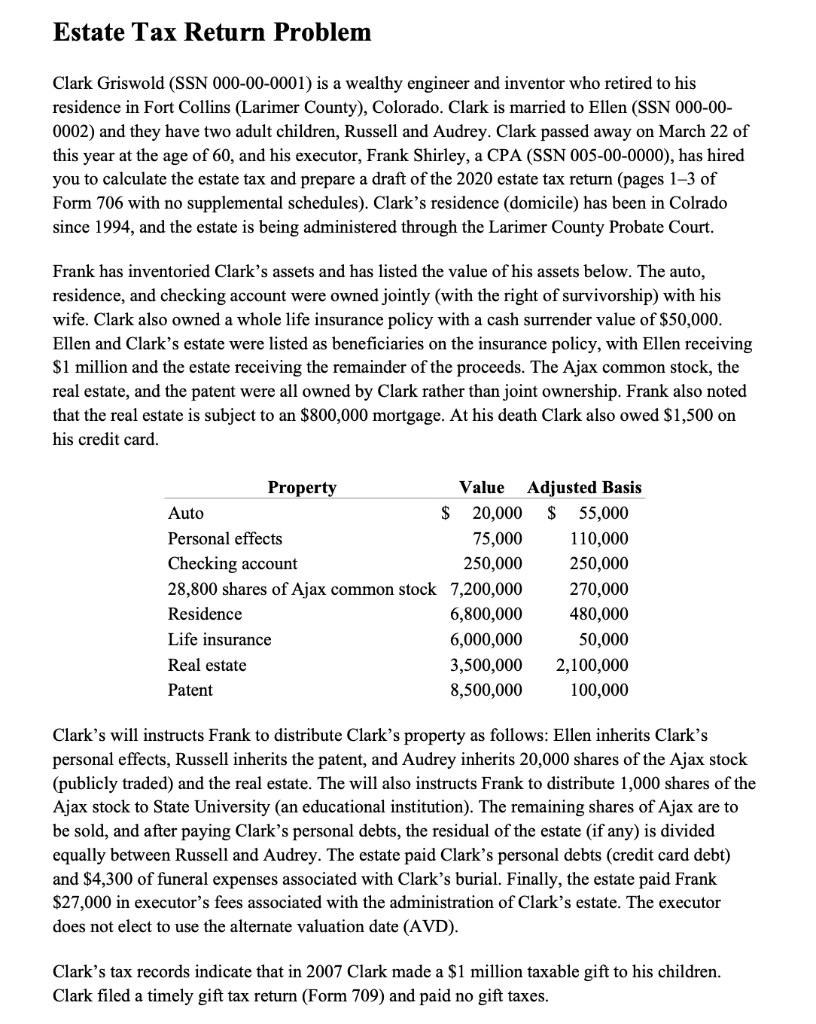

Solved Estate Tax Return Problem Clark Griswold Ssn Chegg Com

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Property Tax Increases Could Be Capped By 2022 Ballot Measure Colorado Public Radio

Tax Related Estate Planning Lee Kiefer Park

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Sample Computation Of Estate Tax Pdf

Colorado Health Legal And End Of Life Resources Everplans

Colorado Estate Planning Leave A Legacy Via Your Estate Plan

Denver Colorado Co Tax Attorney Planning Lawyers Specialist Estate

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Fiduciary Income Tax Department Of Revenue Taxation

Estates Trusts Department Of Revenue Taxation

State Corporate Income Tax Rates And Brackets Tax Foundation

State Estate And Inheritance Taxes Itep

Colorado Residents Must Respond To Major Estate Tax Proposal Boulder Estate Planning Legal Blog September 23 2021